Minnewaukan Community Endowment Fund

- About

- Grant History

- Apply for a Grant

- Leave a Legacy

About the Minnewaukan Community Endowment Fund

The Minnewaukan Community Endowment Fund was established in 1981 to make grants for community projects in the Minnewaukan area. The Foundation is affiliated with the North Dakota Community Foundation, which is a nonprofit, tax-exempt corporation under IRS code 501(c)(3) and North Dakota Law.

The Minnewaukan Community Endowment Fund is managed locally by a group of volunteers whose main activities are building the fund and recommending grants annually.

Local Advisory Committee

Sherri Thompson

Matt Seufert

Sharon Ebach

Trish McQuoid

Contact

City of Minnewaukan

PO Box 192

Minnewaukan, ND 58351

Kara Geiger

Development Director, NDCF

701-222-8349

Kara@NDCF.net

A grant to the Minnewaukan Rural Fire Protection District in 2019 provided appliances for the new fire station.

Grants Awarded in 2024

- Maddock Memorial Home - $460 for pantry shelving

- Minnewaukan 55 Club - $5,500 Minnewaukan 55 Club Structure Project

Grants Awarded in 2023

- Benson County Sheriff's Office - $5,360 for body cameras

- Minnewaukan 55 Club - $3,600 for Minnewaukan 55 Club Structure Project

Grants Awarded in 2022

- Minnewaukan 55 Club - $2,280 Club Structure Project

- Minnewaukan Rural Fire Protection District - $3,700 for G1 SCBA masks

Grants Awarded in 2021

- Minnewaukan 55 Club - $2,800 Club Structure Project

- Minnewaukan Rural Fire Protection District - $2,800 Standby Generator

Grant Awarded in 2020

- Minnewaukan Rural Fire Protection District - $5,600 for Extractor / Washer

Grants Awarded in 2019

- Lake Region District Health - Benson County - $500 for Lake Region District Health Unit - Benson County

- Minnewaukan High School Trap Team - $500 for Minnewaukan Trap Team

- Minnewaukan Rural Fire Protection District - $4,451.73 for New Fire Hall

How to Apply for a Grant

Grant Guidelines:

- Organizations must be recognized under IRS code 501(c)(3) to qualify for a grant. Any organization with an official relationship to city or state government (school, park district etc.) would also qualify. No grants shall be made to individuals.

- Grants shall be awarded to organizations that serve the Minnewaukan area.

- Requests for day-to-day operations may receive a lower priority.

- Grants for multi-year requests (pledges) will not be made, however an organization may re-apply for a grant each year, provided all previous grant reporting was completed.

- Grants to religious organizations will be limited to those activities which are non-denominational and serve the entire community.

- Grants shall be awarded annually at the discretion of the Advisory Committee.

Deadline: July 15

How to Apply

Step 1 - Review

Review the grant guidelines above to make sure your organization qualifies.

Step 2 - Register

Create an account on our Grants Portal. You will need your organization’s name, EIN, and executive officer's name. Be sure to write down your user name (email address) and password.

Step 3 – Complete Your Application

After registering or logging in, you will arrive at the application section. Click “Apply” to the right of the grant program to which you wish to apply. If you do not see your desired grant program on the list, contact our office. You will be able to save your application and return later to complete it.

Click here for more detailed instructions and tips for using our online grant system.

Plan Your Legacy

Making a lasting difference in our community or for future generations may be easier than you realize. With very simple language in your will or trust, you can help the Minnewaukan Community Endowment Fund (MCEF) continue to support important projects and programs in our area forever.

Gifts to the MCEF are carefully invested by our partner foundation - the North Dakota Community Foundation - to generate a permanent source of charitable income.

If you have children or other relatives, you can leave a portion of your estate to them and a percentage to the MCEF. Doing so provides for your heirs while honoring your charitable values.

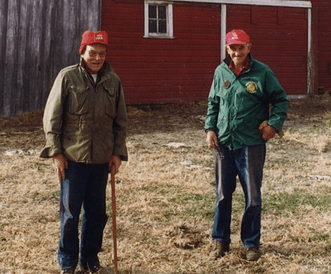

Brothers Russell and Dale Brown left gifts to the communities of Lisbon and Milnor, ND, in their estate plans.

Getting Started

1. Download our free Estate Planning Guide - it contains helpful information and things to consider as you develop your own unique plan.

2. Reach out to a Minnewaukan Community Endowment Fund committee member to learn more about the charities and needs in our area.

3. Consider discussing (confidentially) your vision with our NDCF gift planner Kara Geiger. She has many years of experience helping donors create their charitable vision and better prepare for their discussions with financial planners. You can reach Kara at 701-222-8349 or you can email her at Kara@NDCF.net.

4. Contact your professional advisors (financial planner, attorney and/or accountant) and ask for help in establishing a charitable gift to our foundation.

5. Make sure your will or living trust is up-to-date and reflects your charitable goals.

6. Consider notifying the charitable organizations about the gift you plan to leave them. They will appreciate your generosity and will want to know what you’d like them to do with your eventual gift if it isn't clear.

Language for Your Will or Living Trust

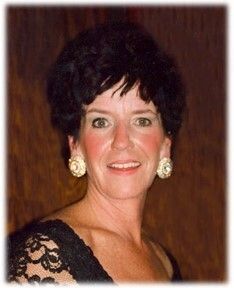

Susanne Mattheis wished to support several different charitable organizations in Bismarck after she passed. NDCF helped her craft a plan that accomplished her charitable goals and provided long-term support to the Public Library, Symphony Orchestra, and five other local entities.

If you would like to include the Minnewaukan Community Endowment Fund in your will, here is some sample language to consider:

“I give and bequeath to the North Dakota Community Foundation (Tax ID Number 45-0336015), a qualified charitable organization under IRS 501(c)(3), located in Bismarck, North Dakota, ___________ (a percentage of the estate, specific dollar amount, or remainder of estate) for the Minnewaukan Community Endowment Fund, a permanent component of the North Dakota Community Foundation.”

* Be sure to contact your legal advisor.

There are many other ways to make a deferred gift to your community, including

- Making NDCF (and your specific community fund) the beneficiary of your life insurance policy, IRA, 401K, or commercial annuity

- Establishing a Charitable Gift Annuity with NDCF

- Other more sophisticated tools, depending on your unique situation

To investigate options and learn more about how other North Dakotans have given back, visit our planned giving website at www.NDCF.net/Plan.