- About

- Grant History

- Apply for a Grant

- Leave a Legacy

About the Hillsboro Community Foundation

Established in 2000 to make grants in support of community projects in the Hillsboro area, the Hillsboro Community Foundation is affiliated with the North Dakota Community Foundation, which is a nonprofit, tax-exempt corporation under IRS code 501(c)(3) and North Dakota Law.

The Hillsboro Community Foundation is managed locally by a group of volunteers whose main activities are building the fund and recommending grants annually.

Local Advisory Committee

Angela Kritzberger, Chair

Don Foss

Bruce Bowersox

Jen Johnson

Jon Dryburgh

Michelle McLean

Deb Mueller

Joy McSparron

Contact

Hillsboro Community Foundation

c/o Dakota Heritage Bank

PO Box 208

Hillsboro, ND 58045

or contact Amy Stromsodt, NDCF Development Director at 701-795-1531.

Annual Reports

The Hillsboro Community Foundation has awarded over $81,000 in 46 grants since its inception in 2000. Recent grant awards are listed below. (includes grants from the Gary Bird Charitable Endowment Fund)

Grants Awarded in 2024

- Hillsboro Public School - $6,400 Inspiring Passion for Learning and School

- Hospice of the Red River Valley - $1,025 Community Grief and Bereavement Program

- Lutheran Social Service of MN - $1,025 LSS North Dakota Senior Companion Program

- Traill County Historical Society - $3,010 new farm equipment building at our Heritage Park location

Grants Awarded in 2023

- BIO Girls - $1,000 for their 2024 program in Hillsboro

- Hillsboro Public School

- $1,265 for building Excitement and Engagement (K-12)

- $1,265 Hillsboro Drama Club

- Our Savior's Lutheran Church - $3,750 Choral Risers for Community Christmas Choir

- Village Family Service Center - $510 School-based mental health therapeutic supplies

- Traill County Historical Society - $3,000 foundation stabilization of Plummer House Museum

Grants Awarded in 2022

- Hillsboro Public School - $3,000 for the Hillsboro School & Community Fitness Center Equipment

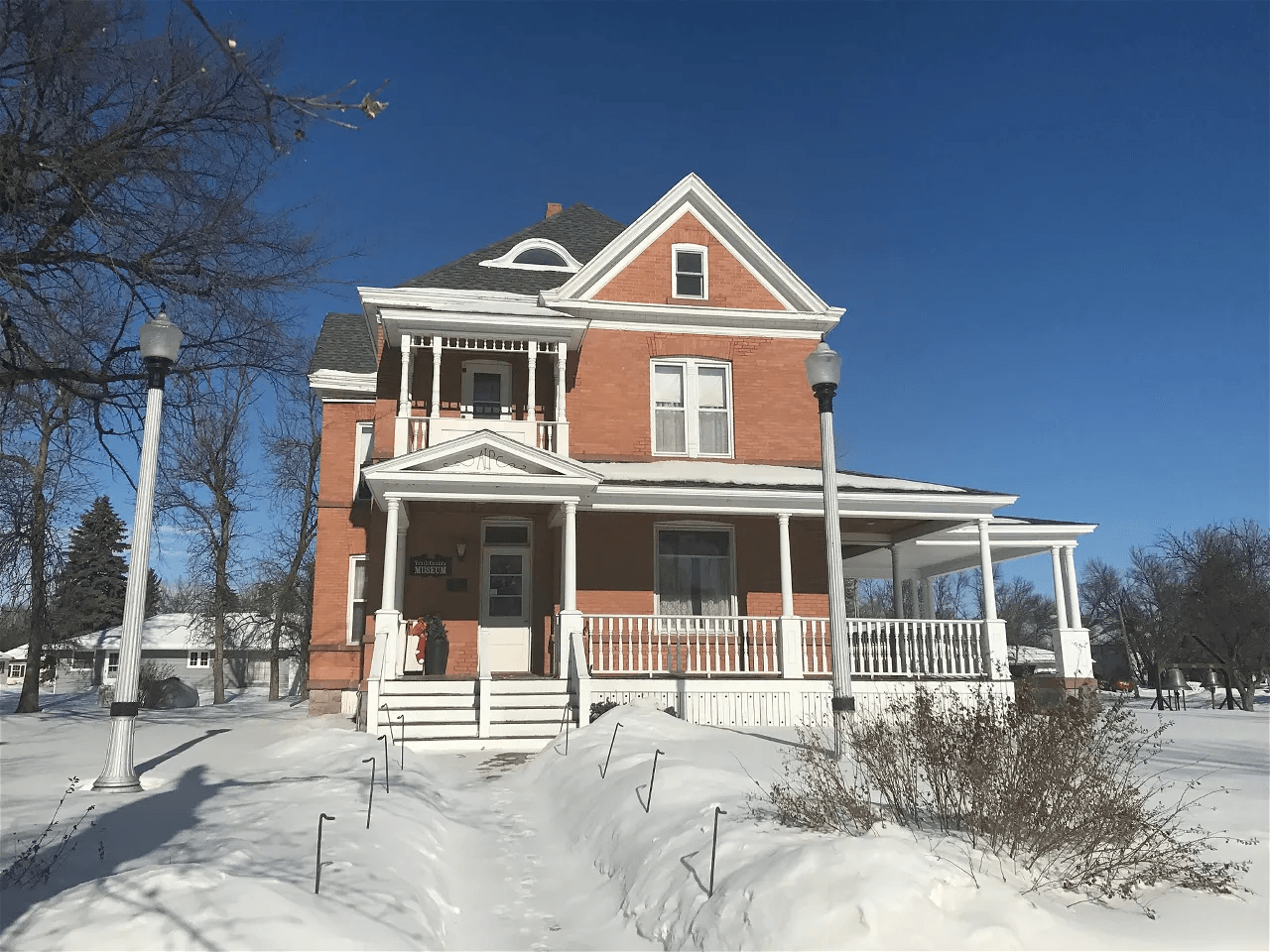

- Traill County Historical Society - $3,000 Plummer House Museum painting trim & mouldings

- BIO Girls - $2,110 for their 2023 program in Hillsboro

- Hillsboro Business Association - $1,750 for a Christmas Street Light Decoration Upgrade

- Hooves and Hearts 4-H Club - $150 for hospital ER bags for children

Grants Awarded in 2021

- Generation II 4-H Club - $140 Comfort/Goodie Bags for Pediatric Patients

- Hillsboro High School - $3,744 Science Department Update

- Traill County Historical Society - $4,454 Plummer House Museum Building Maintenance

- Our Saviors Lutheran Church - $256 for the Hillsboro BackPack Program

- Hillsboro Public School - $256 for their snack program

Grants Awarded in 2020

- Traill County Museum - $2,000 for renovations/repairs to the Portico

- Hillsboro Manor Housing - $4,490 for attic insulation

- Hillsboro Public Schools - $1,570 to purchase technology and classroom library supplies

Grants Awarded in 2019

- Hillsboro Business Association - $2,500 Toward the HBA Tent Project

- Hillsboro Elementary School - $1,284.76 Toward the purchase of technology kits for the Engagement in School & Recess program

- Hillsboro Vets Club Association - $803.24 toward the purchase of a new security alarm system

- Northern Lights Youth Services - $1,487 to purchase 2 picnic tables for concession stand area at the sports complex

- Traill County Historical Society - $1,500 for laptop replacement and additional shelving for records displays

The Traill County Historical Society Museum, AKA The Amos & Lillie Plummer House, is a Queen Anne style home built in Hillsboro in 1897. The museum has benefitted from grants for upkeep and preservation.

How to Apply for a Grant from the Hillsboro Community Foundation

Grant Guidelines:

1. Makes grants only to those organizations designated as a non-profit, tax exempt organization under IRS Code 501(c)(3) or to government agencies.

2. Makes grants to qualifying organizations in the city of Hillsboro.

Applications accepted September 1st-November 1st each year

New for 2019 and Beyond:

We made it easy for you to apply online for a grant!

Step 1 - Review

Review the grant guidelines above to make sure your organization qualifies.

Step 2 - Register

Create an account on our Grants Portal. You will need your organization’s name, EIN, and executive officer's name. Be sure to write down your user name (email address) and password.

Step 3 – Complete Your Application

After registering or logging in, you will arrive at the application section. Click “Apply” to the right of the grant program to which you wish to apply. If you do not see your desired grant program on the list, contact our office. You will be able to save your application and return later to complete it.

Click here for more detailed instructions and tips for using our online grant system. (PDF)

Plan Your Legacy

Making a lasting difference in our community or for future generations may be easier than you realize. With very simple language in your will or trust, you can help the Hillsboro Community Foundation (HCF) continue to support important projects and programs in our area forever.

Gifts to the HCF are carefully invested by our partner foundation - the North Dakota Community Foundation - to generate a permanent source of charitable income.

If you have children or other relatives, you can leave a portion of your estate to them and a percentage to the HCF. Doing so provides for your heirs while honoring your charitable values.

Brothers Russell and Dale Brown left gifts to the communities of Lisbon and Milnor, ND, in their estate plans.

Getting Started

1. Download our free Estate Planning Guide - it contains helpful information and things to consider as you develop your own unique plan.

2. Reach out to a Hillsboro Community Foundation committee member to learn more about the charities and needs in our area.

3. Consider discussing (confidentially) your vision with our NDCF gift planner Amy Stromsodt. She has many years of experience helping donors create their charitable vision and better prepare for their discussions with financial planners. Amy's cell is 701-741-3193 or you can email her at Amy@NDCF.net.

4. Contact your professional advisors (financial planner, attorney and/or accountant) and ask for help in establishing a charitable gift to our foundation.

5. Make sure your will or living trust is up-to-date and reflects your charitable goals.

6. Consider notifying the charitable organizations about the gift you plan to leave them. They will appreciate your generosity and will want to know what you’d like them to do with your eventual gift if it isn't clear.

Language for Your Will or Living Trust

Susanne Mattheis wished to support several different charitable organizations in Bismarck after she passed. NDCF helped her craft a plan that accomplished her charitable goals and provided long-term support to the Public Library, Symphony Orchestra, and five other local entities.

If you would like to include the Hillsboro Community Foundation in your will, here is some sample language to consider:

“I give and bequeath to the North Dakota Community Foundation (Tax ID Number 45-0336015), a qualified charitable organization under IRS 501(c)(3), located in Bismarck, North Dakota, ___________ (a percentage of the estate, specific dollar amount, or remainder of estate) for the Hillsboro Community Foundation, a permanent component of the North Dakota Community Foundation.”

* Be sure to contact your legal advisor.

There are many other ways to make a deferred gift to your community, including

- Making NDCF (and your specific community fund) the beneficiary of your life insurance policy, IRA, 401K, or commercial annuity

- Establishing a Charitable Gift Annuity with NDCF

- Other more sophisticated tools, depending on your unique situation

To investigate options and learn more about how other North Dakotans have given back, visit our planned giving website at www.NDCF.net/Plan.